Embedded Finance Seamlessly

Company: AREX Markets · Role: Product Design Lead · Date: 2021/2022

- B2B

- SaaS

- Fintech

- Branding

ROLE

Founding Product Designer.

TEAM

Cross-functional partnership between a Product Manager, a Front-End Developer, and an Engineering Manager. Collaborating with the Head of Product and the Head of Marketing on rebranding.

TIMEFRAME

April 2021 - June 2021.

Problem Statement

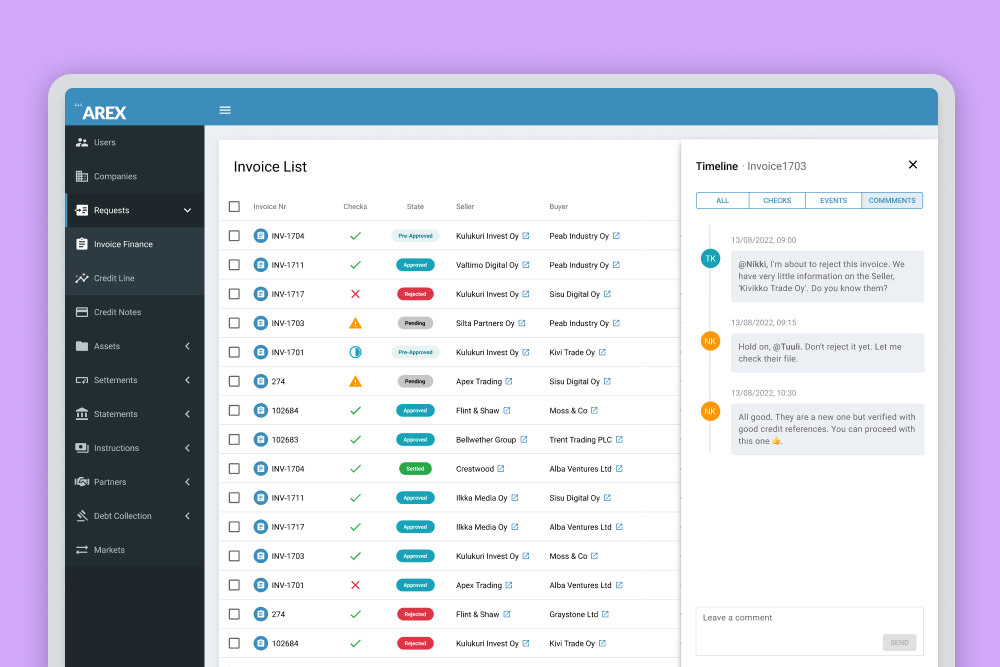

AREX was founded in Ireland in 2014, launching its operations in the Nordics. Its value proposition focused on an invoice financing (factoring) model for SMEs. The company developed its investment marketplace and converted invoices into a financial asset—the ETR (Exchange Traded Receivable)—and auctioned them on its platform to qualified professional investors. In 2021, the company initiated an international expansion into the UK and Spain, and wanted to execute a new strategic vision to achieve exponential growth.

The strategic goal of AREX was to pivot to what was termed an Embedded Finance strategy. In other words, to bring AREX's service to where thousands of SMEs already were: inside their accounting software, neobanks, and other digital tools they use daily. At a product level, the platform needed to be flexible enough to support two strategic integration models: co-branded and white-label.

The Challenge

How might we design the complete user experience for the new Embedded Finance experience, making it feel seamless, native, and capable of generating maximum trust and clarity for the end-user at the crucial moment of accepting financing?

To add a layer of complexity, this work was developed in parallel with a full rebranding of the AREX interfaces.

This case study specifically focuses on the design of a co-branded solution for one of our strategic partners: Xero.

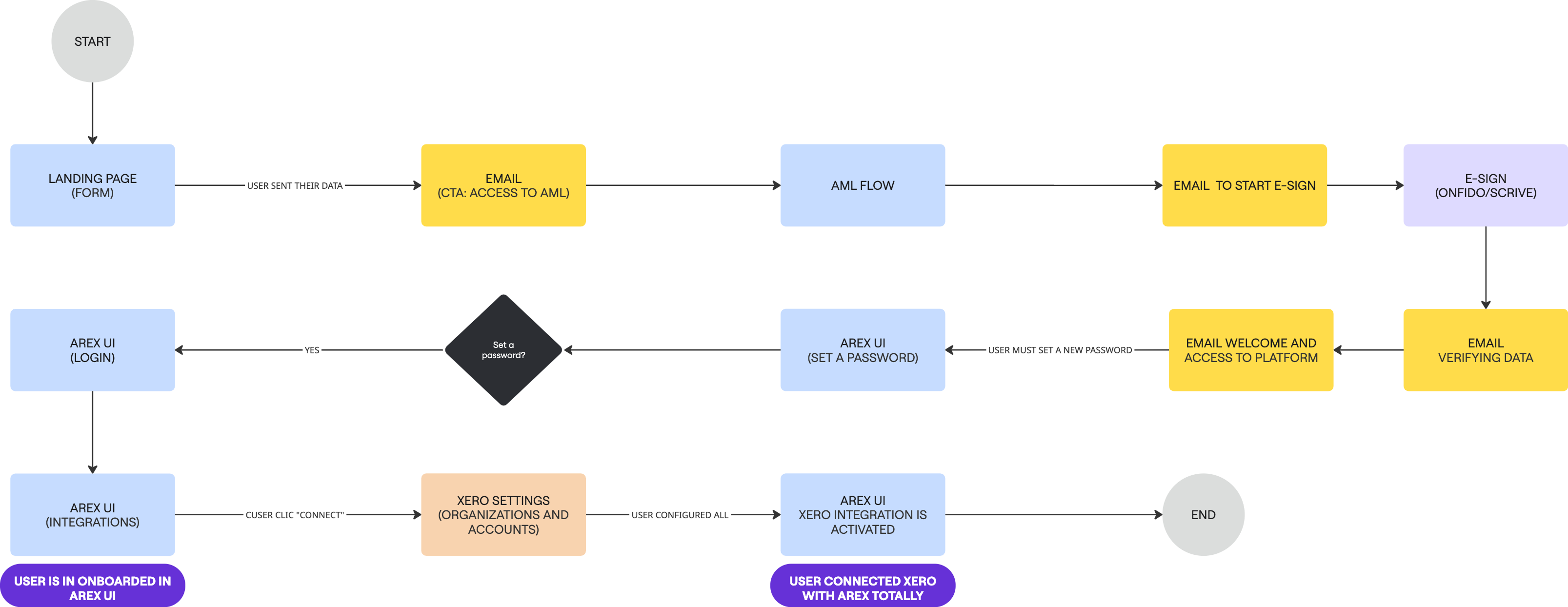

Mapping the End-to-End Embedded Finance Experience

To tackle this challenge, I defined the complete user experience, divided into three major phases taking place across different flows:

- The Onboarding Flow.

- The AREX Platform.

- The Xero Interface (embedded experience).

I mapped out the complete user flow for this experience as a result of several working sessions with the Product Manager and the Engineering Manager.

1. The onboarding flow

The Co-Branded Landing Page.

A co-branded landing page designed with the dual objective of building trust and serving as the starting point for customers' onboarding.

Partnering with the Head of Marketing, I co-defined our new brand strategy. This involved optimizing the brand's signature blue and green print colors for digital use.

In collaboration with the PM, we decided to build the landing page in HubSpot, enabling the Salesteam to track leads.

I chose to design a template from scratch with a modular and reusable structure for future partnerships.

Anti-money Laundering (AML) verification & Signing.

The Anti-Money Laundering (AML) verification was a mandatory process that allowed AREX to perform the necessary due diligence to determine if a business was eligible for financing. (Accessed via a link sent by email, after completing the landing page form).

Given that our Front-End developer was occupied with platform development for this project, the PM and I opted to create the AML flow with Bubble.io, a no-code platform. This strategic decision provided us with remarkable agility for rapid iteration

Knowing that AML was a point of friction, I monitored sessions with Smartlook from day one.

We integrated the specialized solution from Onfido, powered by Scrive, ensuring maximum security without internal development for the Signign.

Analyzing the user recordings allowed us to iterate within the first week, adding contextual help messages and microcopy to the fields that caused the most confusion.

2. Connecting with Xero from AREX Platform

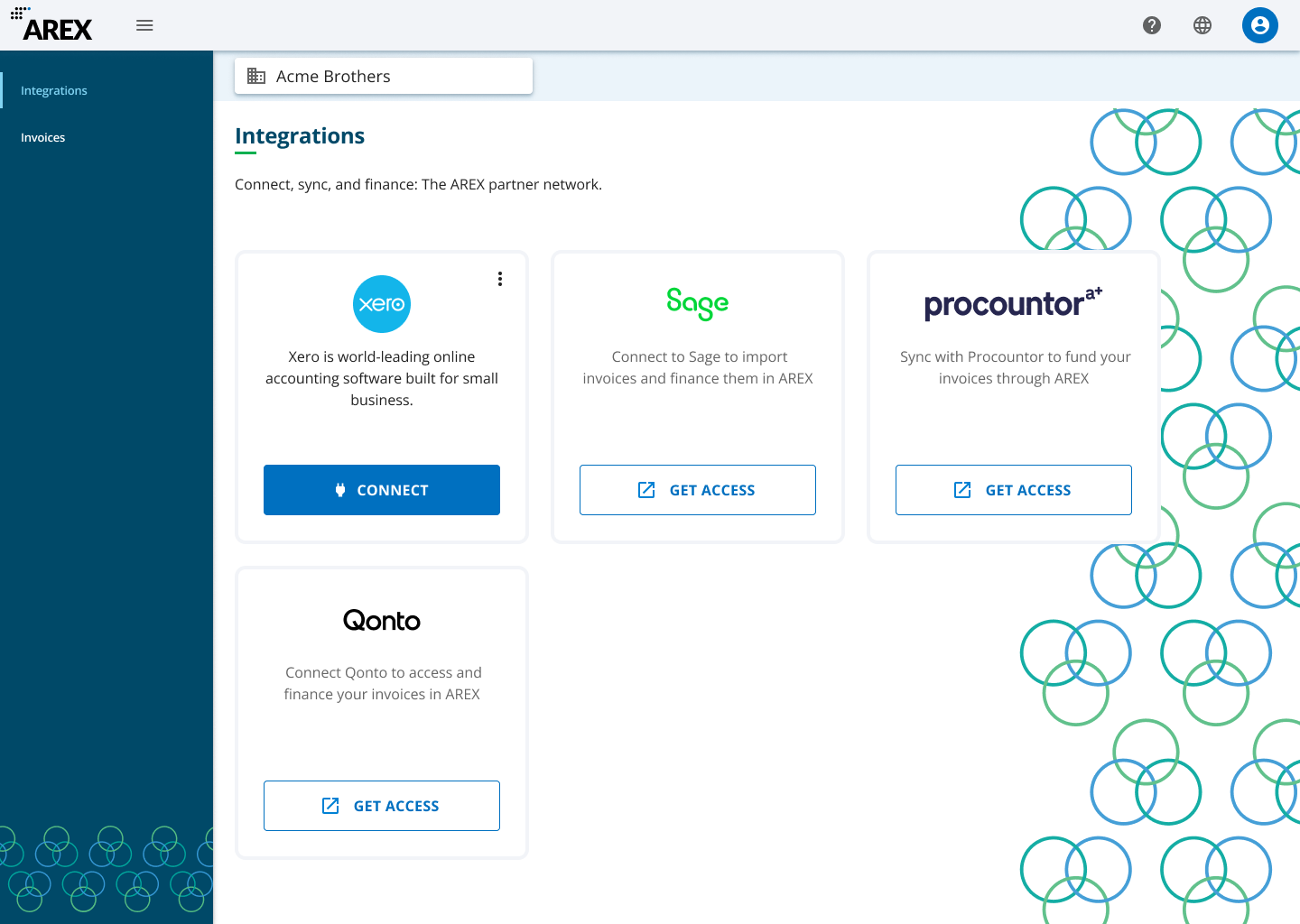

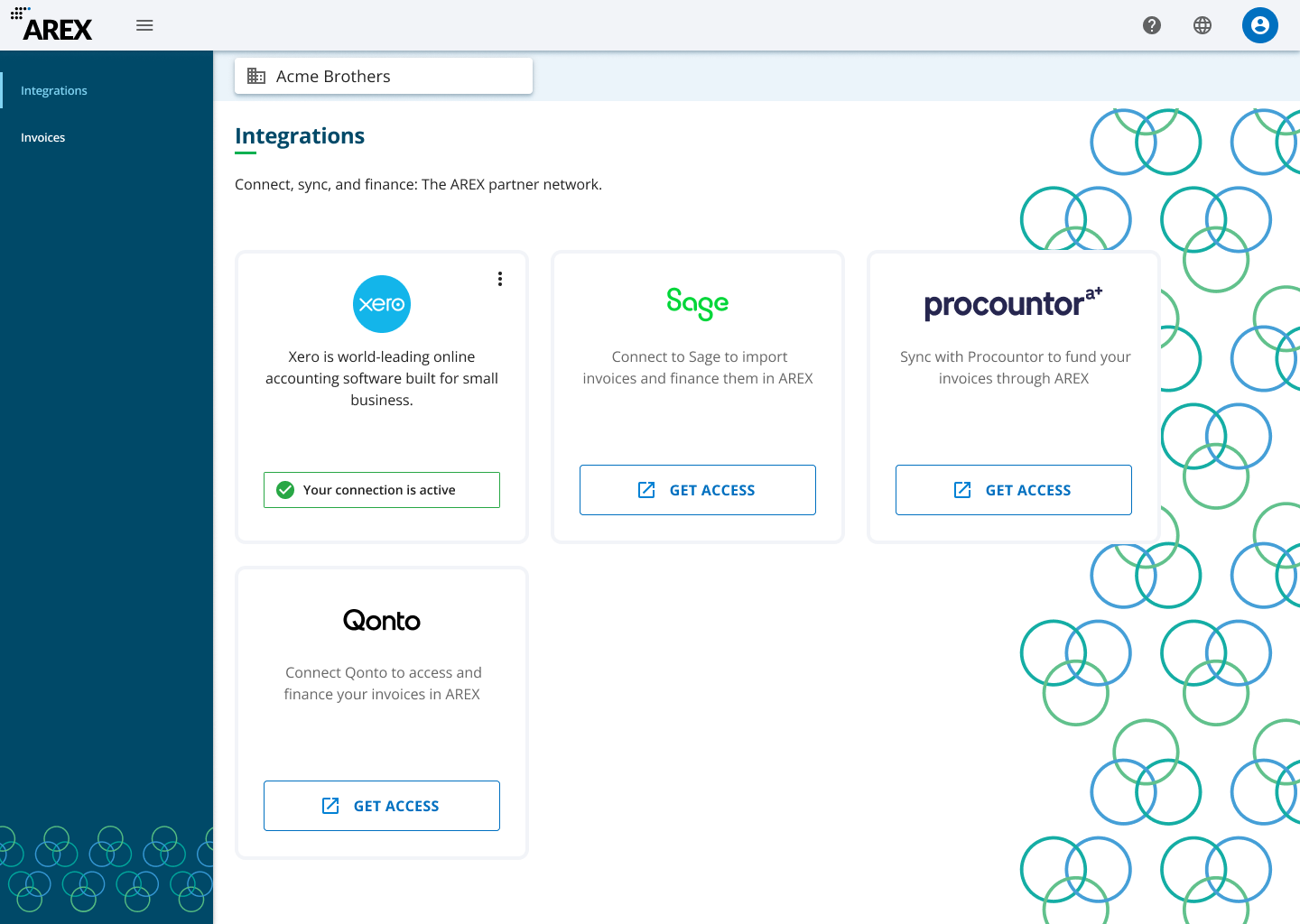

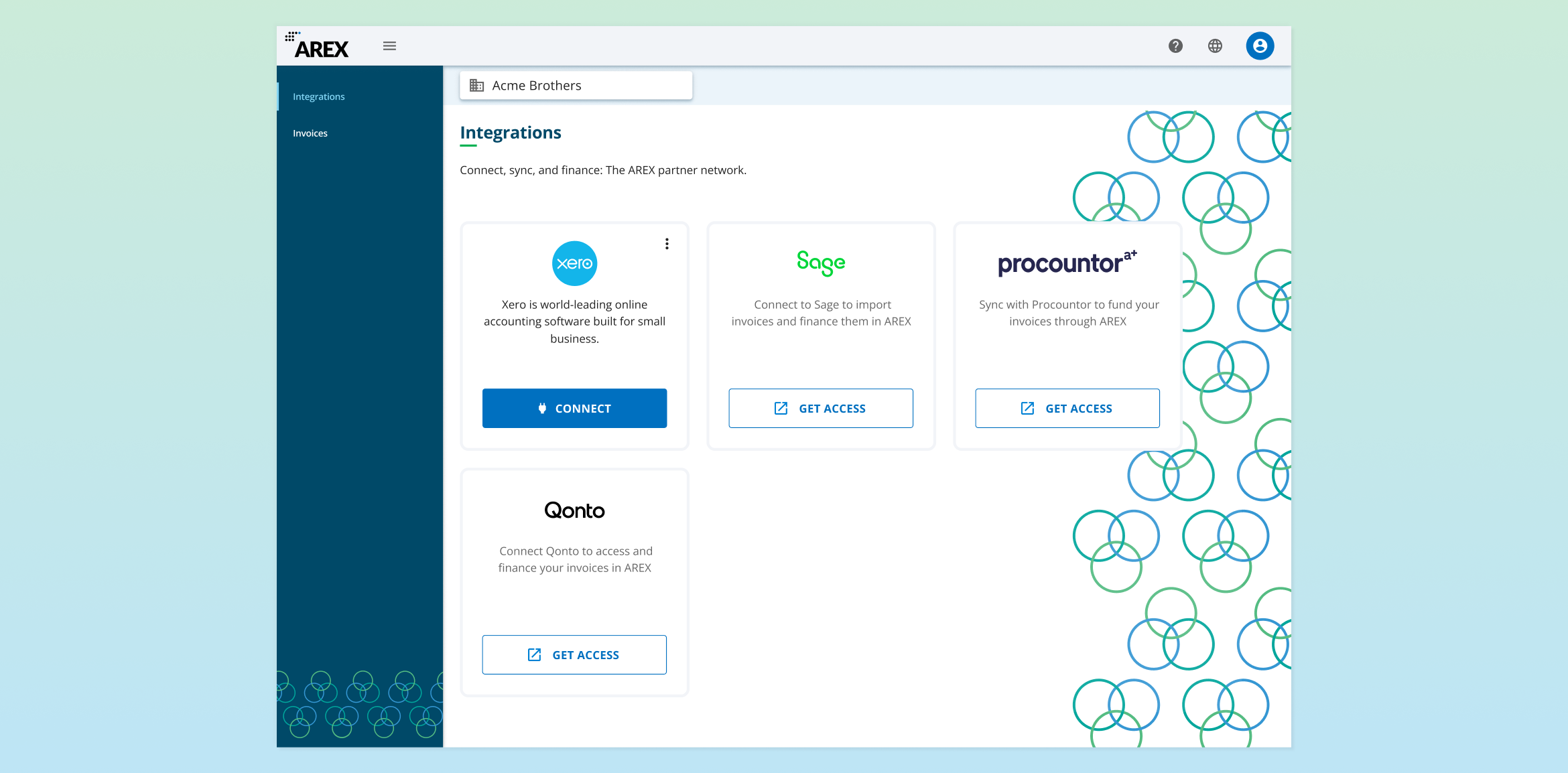

After signing, a welcome email guided the user through password creation. Upon their first login, they landed directly on the "Integrations" section, a screen presenting each potential integration as a separate card.

The Xero card features a primary "Connect" button that launches a secure, Xero-managed window for the user to authorize the integration and link their key accounts.

Once completed, the connection is active, and from that moment on, the user can operate directly from their Xero interface to select the invoices they want to finance with AREX, fulfilling the promise of Embedded Finance.

🤗 Video: The Embedded Finance Experience.

3. The Embedded Experience: Operating from Xero

The financing process was designed to be a seamless, non-intrusive part of their existing accounting routine.

Solving this challenge was a deeply collaborative effort between Product, Design, and Engineering—both at AREX and Xero. Our Engineering Manager, working with his counterpart at Xero, identified that their API provided a unique, non-intrusive way to trigger the financing flow. Based on their technical guidance, the Product Manager and I decided to leverage an existing and familiar feature for users: Branding Themes. This meant that instead of adding a new, unfamiliar button, we proposed a theme called "AREX Invoice."

The Native Financing Flow was a deeply collaborative effort between Product, Design, and Engineering.

🤗 Video of the financing flow on the Xero interface:

Notifications

To address the anxiety inherent in any financial process, the design was centered on proactive transparency. I designed an in-app notification system that kept the user informed at every stage, answering their key question: "What's happening with my money?".

Strategically, the integration was built so our partner could also trigger these alerts via email, using data from our API. My recommendation was to activate this option to ensure an omnichannel experience, keeping users informed.

The key notifications included:

- Approval: Confirmation that the invoice was eligible for financing.

- Payment: A real-time alert when the advance was deposited into their account.

- Settlement: Notification that the debtor had paid and the final funds were released, closing the loop.

Impact

🚀 24h funding

for SMEs

✨ +90K invoices

processed

🎯 +500M SMEs

within reach

🤝And securing key partnerships with Sage and Qonto, among others.

Reflections on my journey

✨ Design as the Foundation of B2B Trust. In an "embedded" product, visual and brand consistency is not merely decorative, but strategic. I learned that for a major partner like Xero to integrate our product, our design must project the same level of trust and professionalism as theirs.

✨ Pragmatism Over Technical Perfection. The decision to use a no-code tool taught me that speed-to-feedback is a competitive advantage.

Selected work

Unlocking Real-Time Team PerformanceSaaS - B2B

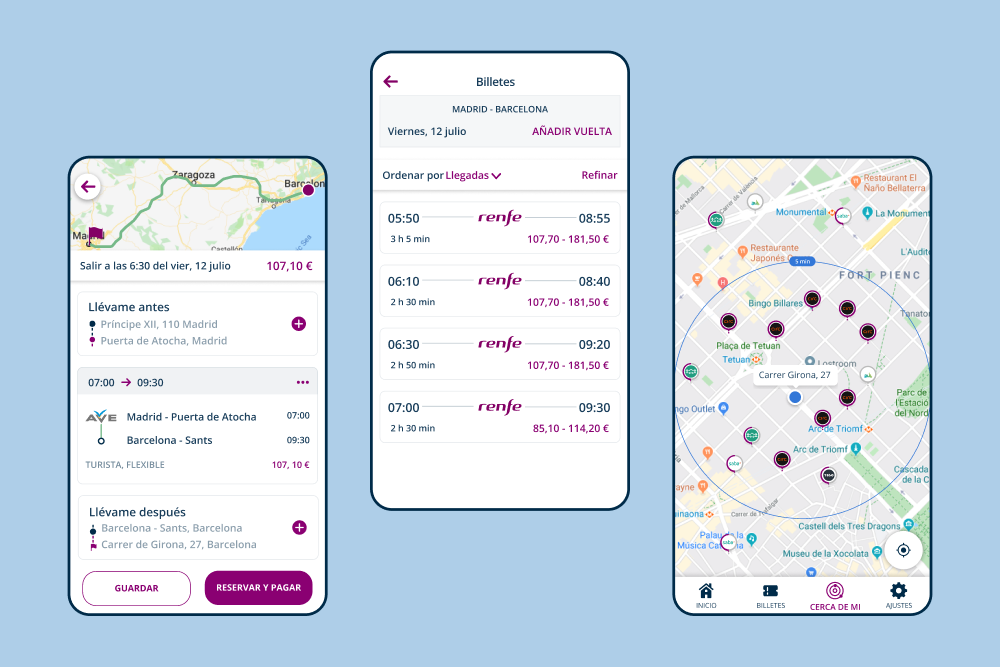

A Door-to-Door Journey Pilot for Renfe MaaS - SaaS - B2B - Mobile

Humanizing the Fintech Back OfficeFintech - SaaS - B2B

Embedded Finance SeamlesslyFintech - SaaS - B2B

Partner Portal, a System for ConsistencyFintech - SaaS - B2B

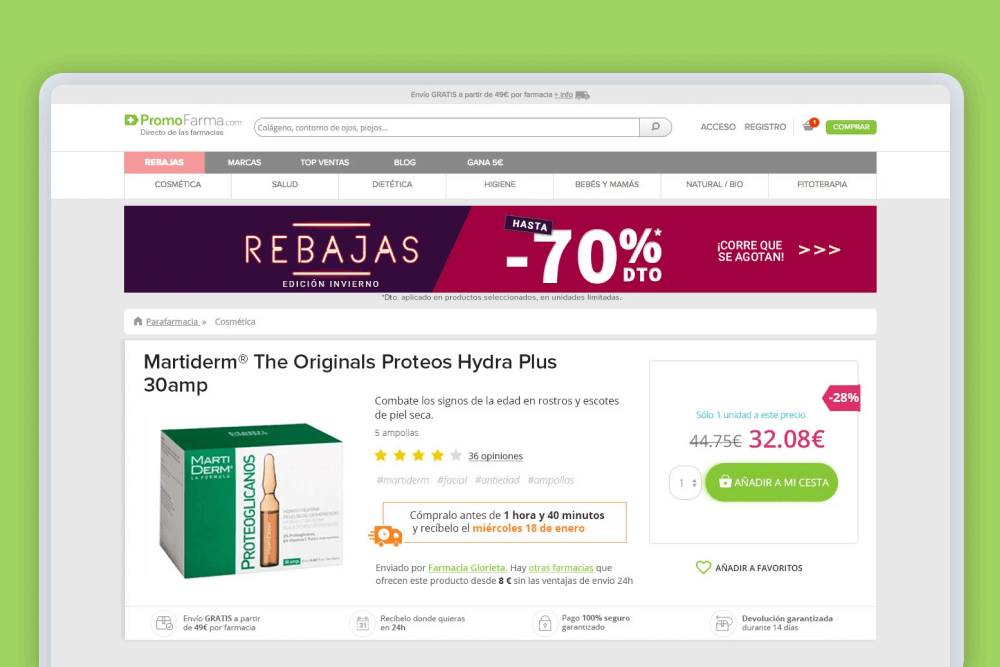

Combat Shopping Cart Abandonment - Promofarma Marketplace - E-Commerce - B2C